MACHINE GUN (ES / MES) - Trend following strategy

🌟🌟 Trend following strategy for ES (SP500) 🌟🌟

Go on the offensive. You will have fun with this strategy. Lots of trades, with small TP (Take Profit) and SL (Stop Loss). Optimal results in bull markets.

Strategy type: Trend following (LONG-ONLY)

General comments: Very simple strategy to leave it run. Narrow take profit and stop loss. Expected to be plain during choppy markets or downtrends, and so profitable in bull markets.

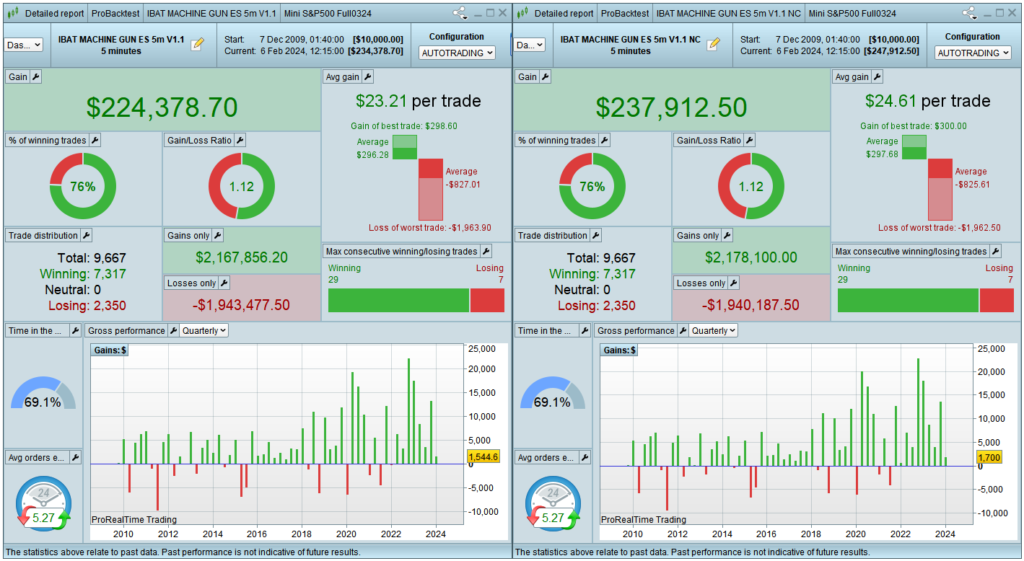

The previous image depicts the full backtest (BT) using one contract in MES (Micro ES). On the left, broker costs are already accounted for, showing a 'clean profit'. On the right is the same system without considering broker costs. This specific trading system initiates thousands of short-lived trades, making fees significantly relevant. Indeed, this strategy cannot be profitable using CFDs and is only viable due to Interactive Brokers' low costs and fees, which are substantially lower than those of CFD brokers.

Using Mini ES (ES) instead of the micro version, the fees become insignificant given the substantial impact on MES.

This discussion on broker fees is especially pertinent here with thousands of operations (and 5-10 ops daily), but much less important in other strategies considered to be swing strategies (with longer trades and fewer entries), like in the case of the majority of trading systems in our catalogue and for our other vendors.

12 months license - Trading System for ProRealTime platform - Compatible with FUTURES accounts - Not a FUTURES account?

Do you want this system for free? Visit freeprorealtimeibkraccount.com

🔥 Discover the power of our system firsthand! Download our demo here to launch the system by yourself. Access to fully detailed reports, latest results and real-time positions in your own ProRealTime 💼

— OR —

Make the payment to the next address and send us an email indicating the desired products to info@ibkrautotraing.com